This morning I was browsing my Google Reader while deciding whether or not to go out for a bike ride before the sun scorches the park and everything that's in it, when I came across an interesting blog post from Richard Heale, a digital agency expert. In it, he was discussing the challenges digital marketing agencies face with Pharma companies and differences in culture that may arise:

"The core problem didn’t lie in the quality of previous digital

leadership or the staff, rather it was the cultural divide between

traditional agency staff and the new kids on the block."

That singular thought also sums up the divide in Pharma incredibly well too. We are at the cross roads between the traditionalist baby boomer generation in senior management positions and the up and coming kids who are Gen X and Y – they are think differently, not only from experience, but also from the web culture they grew up in.

If you look at the precise years, I'm one of the last of the baby boomers, being born in the very last year with a couple of months to go, yet I often find myself more in common with Gen X than the 'old farts' as they love to label themselves, who focus on traditional media, DTC and all that goes with it. The world has changed. Social media and the new digital age has ensured that. Things are much more fast paced, you can monitor and track progress by computer rather than laboriously Google by hand in a darkened cave somewhere.

The other week, I was meeting some Pharma people and we were discussing competitive intelligence. Not the old fashioned, primary research of phoning around kind of intelligence, but using modern computing, alerts and database search techniques to find accurate, essential information at the press of a button. They were freaked. Completely. Partly awed, partly wowed and partly scared because their world is changing fast and that makes them uncomfortable. Suddenly, the vendor is in a different place, a smarter, faster, altogether wilder place with real time information. Yes, real time. That's the new future technology that's happening right here, right now. Look at Google Wave, at Twitter, at Friendfeed and all sorts of other web 2.0 tools you can use to your advantage, if you know how. A few clicks and you're done.

If I were still on the Pharma marketing side, I'd want a cool vendor like that, getting me real time alerts and accurate, referenceable information I can trust for a much cheaper price. Who said telephone convos or emails from sources were accurate? Actually, they're not; they're subjective and highly susceptible to hearsay, yet traditionalists swear by this primary research approach and often make multimillion dollar campaign decisions on the back of them. Ye gads.

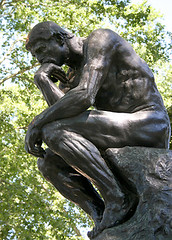

Image by LensENVY via Flickr

Image by LensENVY via Flickr

Going back to digital marketing approach mentioned earlier, it occurred to me that the traditionalists see this as really just websites, branded or unbranded, and often not as something effective either. In many ways, that's quite true because in the web 1.0 world, pushing information without engagement doesn't work very well. Why? It's biased, it's sponsored, it doesn't let the consumer or HCP engage in a dialogue and quite simply, they aren't fooled by push marketing anyway. When on earth are the patient advocates in this model? Yet learn to listen, engage and work with them in new ways and they will often be your best friends and promoters.

Now imagine some of the new web 2.0 tools on Google Groups, Facebook, YouTube, blogs etc etc (assuming comments are enabled), then you can get a very different type of interaction and feedback. Scary? You betcha, but as more young marketers and PR people start running Pharma brands and e-marketing/digital strategy, so we will see a different type of e-marketing evolve, hopefully for the better. I'm thinking of bright, smart and articulate young things like @shwen and @bradatpharma, who get the power and reach of these new technologies and want to help others too.

At the end of the day, after experiencing both sides of the industry, I've long since realised that the pervasive legal conservatism isn't so much of a hurdle, as an excuse, and a rather lazy one at that. Most internal review teams are more creative and flexible than brand teams give them credit for. In order to get what you want, you first have to give others what they want – in this case, some well thought out and reasoned reassurances and action plans for handling things than may occur.

The world is a-changing – the big question is will Pharma change with it or be left behind?

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d75a8718-2183-4e20-a4d7-937584a7bdf4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0fad169d-f76b-43a9-a823-2d5dffd73271)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7dc68a20-84f2-4736-b2e6-fcdd841b73ec)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c74c3016-979d-460d-9ea9-1a9d1e72501c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7377e911-70c9-48ce-a63a-315960fcd889)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=8a15b948-b9b6-4957-8d86-194cd9411f58)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=00682cb7-0903-402d-a88d-a9484182f301)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b0e49631-506d-4c46-9ca1-b55b39cc6654)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e647bd43-8d6a-4a73-91f5-b4d11842d6df)