Update on iNHL and CLL – idelalisib, obinutuzumab and ibrutinib

Yesterday, Gilead announced on their 2Q Earnings Call that they plan to file their PI3K delta inhibitor, idelalisib (formerly CAL-101), with the FDA later this year in indolent non-Hodgkin’s Lymphoma (iNHL). Discussions with both FDA and EMA have already been initiated based on the phase II results in CLL and iNHL.

Many of you will recall the CLL data presented at ASCO by Dr O’Brien (MD Anderson) and Jennifer Brown (Dana Farber), followed by the iNHL data update presented in Lugano by Dr Salles (Lyon Sud).

The single arm NHL study 101-09 evaluated idelalisib (150 mg BID) in patients (n=125) who were refractory to rituximab and alkylating agents. In other words, there is a high unmet medical need for a new alternative therapy option.

As background, recall that previous trials with ofatumumab (4 prior regimens) and bendamustine (2 prior regimens) demonstrated an overall response rate (ORR) of 22% and 76% respectively, with a duration of response (DOR) of around 5.8 and 10 months.

In study 101-09, patients received approximately 4 prior regimens (maximum was 12) and are therefore more comparable to the ofatumumab study in terms of prior therapy. Interestingly, 65% also received bendamustine in addition to rituximab and alkylating agents, while 63% received an anthracycline.

Instead of an ORR in the expected 20-30% range, the actual number was an impressive 53.6%.

What about the DOR you may be thinking? 11.9 months.

Progression-free survival (PFS) was 11.4 months.

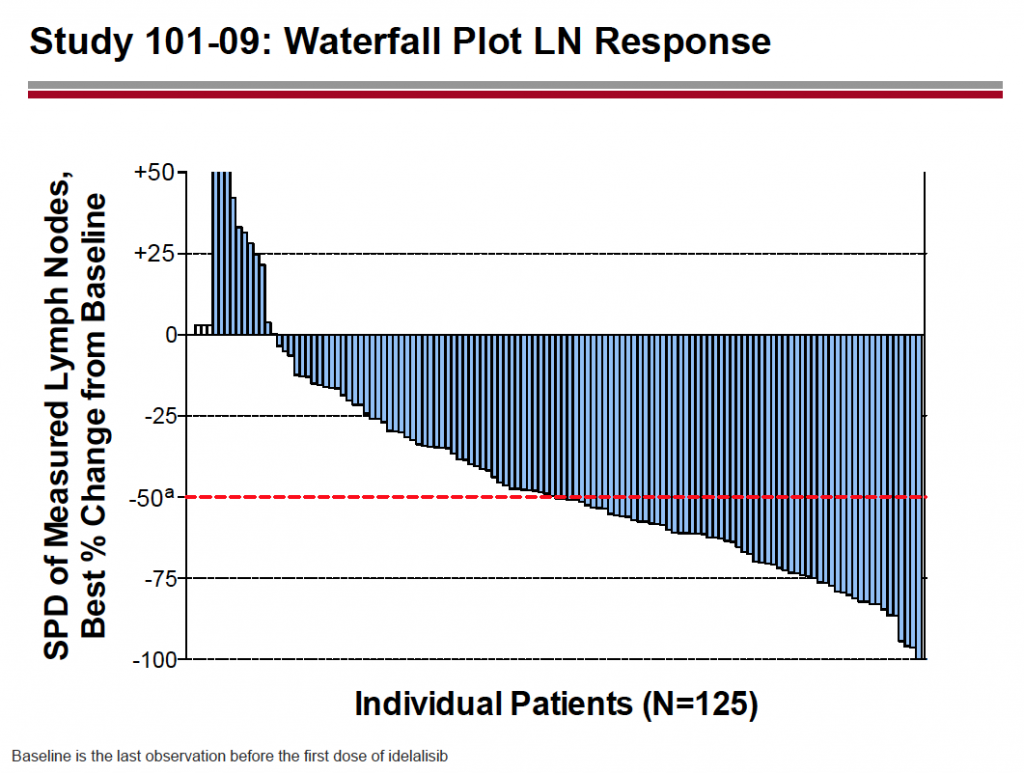

The waterfall plot tells a bigger picture:

Source: Gilead

Side effects were similar to those previously reported, with diarrhea, fatigue, cough and nausea being the most common. The only grade 3 event in double figures was diarrhea (10%). Almost half (48%) saw raised liver enzymes (ALT or AST), with 13% experiencing grade 3 or more. Hematologic events were mainly decreased neutrophils (53%) with a quarter (26%) experiencing grade 3 or more.

The company also has three phase III trials in CLL ongoing.

In particular, Study 116 (idelalisib plus rituximab versus rituximab alone in patients unfit for chemoimmunotherapy) is nearly enrolled. The interim analysis is expected in the fourth quarter this year. This trial is a similar population to the German CLL11 study in patients with co-morbidities that compares obinutuzumab and rituximab with chlromabucil to chlorambucil alone.

No doubt if the interim analysis is promising, then further Health Authority discussions will ensue with regards to the CLL approval path for idelalisib.

What does all this mean?

Gilead have gathered solid phase II data for idelalisib in refractory iNHL, an area of high unmet medical need. Whether this would be considered for Accelerated or full approval isn’t yet clear, since there are no surrogate endpoints. It will be interesting to see how the FDA view the data and make an informed decision. No doubt we will hear more later in the year pending discussion with the FDA and their perspective on the data.

My experience from extensive market research and KOL interviews in CLL is that patients with co-morbidities tend to be treated with either chlorambucil or rituximab, both as single agents. Thus having two new therapies ie obinutuzumab and idelalisib (in different combinations) potentially available in the near future would transform this particular disease segment, create new standards of care, offer more therapeutic options and raise the bar for future entrants.

Pharmacyclics and J&J are also in the mix in CLL and NHL with their BTK inhibitor, ibrutinib, having Breakthrough designation and FDA filings have also begun for that compound. These markets will soon become very competitive and it will be interesting to see how the landscape plays out given the lack of biomarkers available to help with decision making. Obviously, the labelled indications will drive initial usage. After that, no one is clear yet on how oncologists will ultimately decide on three different therapies, each with good data. I do think it’s good to see clear progress, that’s ultimately the important thing from a clinical perspective.

Roche/Genentech have Priority Review and a PDUFA data of December 20th for obinutuzumab in front-line CLL, as well as Breakthrough Designation. This could be very timely for the company given the ASH meeting in early December. Pharmacyclics’ ibrutinib is expected to receive rapid approval for CLL and refractory mantle cell lymphoma (MCL). In the meantime, if Gilead file for iNHL by year end, then idelalisib could be commercially available in the first half of 2014.

In addition, both idelalisib and ibrutinib appear to have decent efficacy in CLL patients with 17p deletions, a small subset that tend to have a poorer prognosis.

All of these exciting developments will make it more challenging for other possible agents in development by demonstrating good activity in areas that might have previously appeared attractive as a fast track to market strategy. For patients and oncologists, a surfeit of riches is no bad thing!