The CLL Landscape is rapidly a’changing…

Yesterday evening, Gilead announced that the Data Monitoring Committee (DMC) had recommended early stoppage of the 116 trial, which looks at idelalisib in relapsed/refractory disease in patients who are not eligible for chemotherapy. These patients usually have comorbidities or are elderly and frail, and often receive chlorambucil or rituximab alone. The study compared the combination of idelalisib plus rituximab versus rituximab alone.

Fortunately, the early stoppage was for a good reason – the interim analysis demonstrated a statistically significant improvement in PFS in favour of the combination over rituximab alone. Adverse events were consistent with previous experience of the drug.

I would imagine that Gilead will seek a filing this year in the near future (presumably once the Government shutdown is over) and we can possibly expect a late breaker at ASH. This is good news for CLL patients and at least six months earlier than expected.

Based on this information, I would also expect approval for idelalisib in relapsed/refractory CLL by ASCO next year, a year ahead of schedule. The company have already filed in relapsed/refractory NHL, so the FDA will have a solid safety database from which to make an informed decision.

The frontline CLL trial, presented by Dr Susan O’Brien at ASCO, compared the combination of rituximab plus idelalisib to rituximab alone and is still ongoing. I’m hoping we will have an update on this at ASH in December.

Gilead have undertaken a smart strategy to date with most of their trials in combinations with approved therapies such as rituximab and bendamustine, which will make it easier for community oncologists, who treat the majority of CLL patients, to integrate a new therapy in their existing treatment options. Sometimes, getting these physicians to switch to a new single agent drug from long established practices is harder and slower than people realise.

Adding something to the existing standard of care is a much easier sell to community doctors, who usually have have older, less fit patients than the Academic physicians, who put their younger, good performance patients into clinical trials where possible.

In the runup to ASH, the CLL market is now getting very interesting – and crowded.

Recall that Roche announced their phase III results for GA-101 (obinutuzumab) in the frontline setting for the same patient segment at ASCO. They are expected to gain approval soon, probably before ASH and have breakthrough status in this indication.

Pharmacyclics and J&J previously filed ibrutinib in 3 indications and have breakthrough therapy designation in CLL, NHL and mantle cell lymphoma (MCL) as single agent therapy. Approval is also expected this year. There is no doubt that they have a potent and effective single agent in these diseases.

Obviously, a lot of people have wondered whether a combination of ibrutinib plus idelalisib will lead to better overall response rates than either alone. I actually asked this question of the companies presenting at a NYAS meeting a year or two ago, and predictably, they weren’t too enthusiastic.

Why?

Well, it’s much harder for two companies to collaborate on joint trials than it is for a company to manage two agents of their own. To this end, I’m always arguing that companies with a broad and deep pipeline are more likely to win out in the long run if they have the components for logical combinations in the disease being evaluated in house.

What does all this mean?

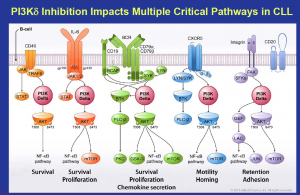

Source: Gilead

What this means is that Gilead and Roche are well placed in CLL and indolent NHL, since Gilead can combine idelalisib (PI3K) with their SYK inhibitor (upstream in the pathway like BTK), GS-993, and Roche can potentially combine GA-101 (anti-CD20) with their Bcl2 inhibitor, ABT-199/GDC-0199.

Many of you will recall the preclinical data at AACR earlier this year looking at Gilead’s two agents and demonstrating some synergies worthy of testing in the clinic. This combination is already in the clinic with two phase II studies currently enrolling in refractory CLL, iNHL and other lymphoid malignancies.

What we should look for is not just the initial response rates and PFS from individual trials, but what the impact of inhibiting two or more pathways will have on survival with subsequent therapies over time. Resistance in leukemias and lymphomas can sometimes take a while to take effect and there are multiple targets to aim at, so cycling different novel combinations by line over time will be interesting to watch.

Strategically, it’s not just about the isolated data with one drug in one line of therapy – we may well see a large improvement in 5 and 10 year survival rates for CLL and iNHL in the long term, with a better quality of life for patients – that’s what oncologists really want to see in the future.

These new developments will undoubtedly put pressure on Infinity, since their PI3K delta/gamma inhibitor is much further behind and will need to define a clear and compelling proposition to differentiate IPI-145 from not only idelalisib (PI3K delta), but also obinutuzumab and ibrutinib.

One thing is clear – such a fertile seam of new therapies – ibrutinib, obinutuzumab and idelalisib in the near term, followed by ABT-199 and IPI-145 in the medium term, is going to change the CLL and iNHL landscapes forever. That’s a good thing for patients, caregivers and oncologists.

ASH is going to be the meeting of the year at this rate… for those of you needing an overview of the leading agents in the CLL/iNHL landscape, check out this pre-ASCO overview here.

One Response to “The CLL Landscape is rapidly a’changing…”

Do you see any emerging technologies that will identify patients most likely to benefit from a given combination? Or perhaps more importantly, those that will not respond to a given combination?

Comments are closed.